- Robo-advisors are cool-headed investors

- There’s a wide variety of AI-run investment platforms

- The pros and cons of using algorithms to manage investments

- Robots automate lending and insurance

- Who’ll be our next favourite banker?

Helping people to manage, send, and save their money has been a profitable business model for hundreds of years. After all, everyone needs financial services, whether they’re average citizens applying for a loan or wealthy corporations transferring profits overseas. And this need gave rise to a global financial services market that’s set to be worth more than $26 trillion by 2022. Thousands of businesses have flocked to the market, increasing competition and luring potential clients with cheaper and better products. But despite these efforts, customer care in this industry leaves a lot to be desired. Many people still go through a paperwork quagmire when applying for loans or asking insurers to pay insurance claims. And money-making services such as wealth management have typically been reserved for rich clientele, as many banks didn’t find it profitable enough to deal with less well-off clients.

The advent of artificial intelligence (AI), however, promises to bring an end to all of this. Unlike humans, AI technologies are unbiased and don’t get tired over time. Also, they automate complex procedures and scale up fast, saving everyone time and money. Fintech startups have already come up with various AI-powered products that, for instance, make insuring a home as easy as navigating through an average mobile app, while getting a loan will no longer require a perfect credit score and lengthy bureaucratic procedures. And now, even customers with just a few thousand dollars can invest their savings in stocks and bonds, benefiting from software tools known as robo-advisors.

Robo-advisors are cool-headed investors

These web-based, automated asset management platforms democratise access to financial markets and help users to find profitable investment opportunities. The first step on that road is telling the robot about your risk tolerance, age, investment timeline, retirement goals, and current portfolio. Then, the AI will set up the account and allocate money to various funds. It will manage the investment continuously, pulling from some stocks and bonds and investing in others to decrease risk or increase profit. Some robo-advisors can also manage money in a way that reduces tax bills through a process known as tax loss harvesting.

These machines operate based on an investment theory known as modern portfolio theory (MPT). The essence of this approach is to take minimal risk in getting maximum returns for a given portfolio of investments. And while there are many variants in how to achieve this, they all come down to diversification, or not putting ‘all eggs in one basket’. Also, robo-advisors aren’t trying to beat the market and provide exceptional returns. Rather, they usually match whole market gains. The financial planner Meg Bartelt says that such an approach is recommended, as “to a large extent, passive investing — the strategy to buy and hold a broadly diversified portfolio and don’t mess with it — has won the day.”

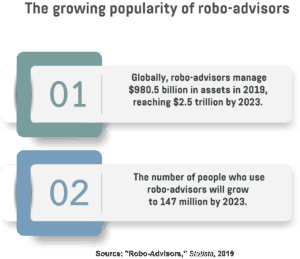

And robo-advisors are also winning customers’ trust. According to Statista, robo-advisors have a staggering $980.5 billion in assets under management worldwide in 2019, and this value is predicted to grow to as much as $2.5 trillion by 2023. What’s more, the number of people who use robo-advisors is expected to grow to 147 million by 2023. And multiple companies are developing robo-advisors to satisfy growing market demands and provide ever more creative features and capabilities.

There’s a wide variety of AI-run investment platforms

One of those firms is Personal Capital, a US-based provider of automated wealth management services, which boasts 19,000 clients in the US and oversees $8.5 billion worth of investments. Its customers can manage their funds using an online platform, but they also have regular access to human financial advisors that help with more complicated financial issues such as retirement planning. And once users connect their bank accounts to the system, they can track the performance of their portfolio and spending trends. But using Personal Capital costs money. Depending on the amount of money they’ve invested, clients pay an annual fee of 0.49 to 0.89 per cent.

However, some customers aren’t satisfied with ordinary robo-advisors, as they want not only to earn money, but also to address certain social issues. Fortunately, the Canadian robo-advisor firm Wealthsimple offers a solution. Its clients can instruct the software to allocate money to companies that, for instance, support gender diversity, promote affordable housing, or combat carbon emissions. The AI will still perform traditional operations such as rebalancing and tax loss harvesting, trying to earn a substantial return for investors. Users that invest up to $5,000 pay no annual fee, while accounts with up to $100,000 pay a 0.50 per cent fee.

The SoFi Wealth robo-advisor is even more competitive than Wealthsimple. This American company manages portfolios of up to $10,000 for free and charges only 0.25 per cent for a balance over $10,000. The company also helps young professionals to refinance student loans. Furthermore, it provides various other financial products such as personal loans, home loans, mortgage refinancing, car insurance, and life insurance. The company is essentially trying to grow into a one-stop-shop for all money-related services that its customers might ever need.

Clearly, some of the most advanced AI-driven investment management platforms are based in North America. Other regions, nonetheless, are catching up and offer equally impressive solutions. In the UK, for instance, a robo-advisor named Nutmeg is increasingly popular and has almost $1.9 billion under management, as well as 60,000 clients. It allows customers to have an initial conversation with human advisors for free. And in Spain, the Feelcapital robo-advisor manages clients’ funds for a fixed monthly fee of $17 or an annual fee of around $170. The company is backed by 50 retail investors and operates in Greece as well.

The pros and cons of using algorithms to manage investments

Robo-advisors are growing in popularity with good reason. They’re easily accessible, as customers only need the internet and a computer or smartphone to access their cloud-based accounts. Also, small fees and low minimum requirements turn thousands of people to AI-run investment platforms. And as machines operate without emotions using nothing but smart algorithms, clients are prevented from making hasty decisions that they might regret one day. As such, robo-advisors are an ideal solution for basic portfolios and users that have simple financial goals. But a sizeable investment and more complicated demands require human advisors.

They can develop personalised strategies by getting to know their clients well, unlike AI that relies solely on a brief questionnaire. Also, human experts can take into account other investments the person might have and coordinate them towards achieving a single goal, such as building up retirement savings. And unlike robo-advisory businesses that offer communication with human experts as an expensive additional service, having a traditional adviser means that you can more easily reach out to them. Sure, they might be more expensive, but certain financial advisors charge an hourly rate or fixed fee for consultations, which means that more people can afford face-to-face meetings.

And unlike human financial consultants, robo-advisors haven’t been tested in a time of major economic recession. In other words, we’re not sure whether algorithms are able to outperform humans when operating in a failing economy. They surely can’t talk to their customers and ease their fears when the investment markets go down. All of this, however, doesn’t mean that AI-powered software tools aren’t worth the money. But customers need to be aware of the pros and cons of using advanced technology when managing their assets. And for those that trust algorithms, there are many other programs that deserve their attention as well.

Robots automate lending and insurance

One of those is Lemonade, a US-based startup that began offering homeowners and renters insurance in 2016. Instead of brokers, it uses AI and bots to collect data from clients that can purchase an insurance policy through an app in just a few minutes. Users that want to make a claim need to submit relevant details to the program, and assuming the algorithms approve it, money can be paid out in a matter of seconds. And the reason why this startup can pay out so fast is fairly simple. Traditional insurance companies treat all the premiums received as revenue, and paying out claims means that they’ll lose profit. Delaying payouts can improve the bottom line of these companies. Unlike them, Lemonade treats only a portion of the premiums as its revenue, while the rest of the money is kept readily available to be used for paying out claims. And if there’s some money left at the end of the year, the company donates a certain amount to various global causes through its Giveback policy. Lemonade is currently expanding its services to Europe as well.

ZestFinance is another startup that relies on AI to improve the financial services industry. It has developed an algorithm that uses search, location, payment, and other types of data to develop credit scores for people that have little or no credit history. Banks and insurers can use this software to find more good clients. The company has recently formed a partnership with the Chinese search giant Baidu to help lenders assign credit scores to around 500 million people in China with no credit history. ZestFinance’s AI will analyse the search data of Baidu users, along with other available details, to determine their creditworthiness and refine risk predictions.

Upstart is a US-based AI company that also relies on smart algorithms to decide who should get a loan. It offers credits and provides its technology to other companies through a software-as-a-service model. The firm primarily focuses on college graduates without a comprehensive credit score history and uses their education, SAT scores, GPA, and job experience to determine whether they’re eligible to get a loan, of what size, and at what rate. And the AI has managed to automate at least 40 per cent of the loan approval process, which means that credit applicants don’t need to spend time gathering documents or going through a phone screening.

Who’ll be our next favourite banker?

Some customers might find it hard to trust AI to manage their investments, insurance, and loans. After all, we’re used to the human touch in these situations. But the financial services industry is embracing automation, and new technologies promise to end paperwork and improve customer service. Robo-advisors have already been put to good use to help everyone get a taste of profit earned in investment markets across the globe. And as companies perfect their algorithms, our favourite banker might no longer work in the local bank branch but rather in the cloud.

Share via: