- Stablecoins – a solution to the crypto market’s volatility?

- The best of both worlds

- The total market value of stablecoins is estimated at $3 billion

- Tether is the most popular stablecoin

- Challenges and criticism

- Nearly half of all Bitcoin transactions are estimated to be involved in illegal activity

- Regulatory hurdles

When Bitcoin first appeared in 2009, few could have predicted just how big of an impact cryptocurrencies would have on the world. By the end of 2017, blockchain technology was on everyone’s lips, and it seemed like everybody was trying to get in on the action. Beyond its primary use as a distributed ledger for cryptocurrencies like Bitcoin, the technology soon found a wide variety of applications in other areas as well, including smart contracts, insurance, supply chain monitoring, and online voting.

In December 2017, Bitcoin reached a new all-time high of $19,783. This didn’t last long, however. Troubled by various regulatory issues, Bitcoin experienced a drastic decrease in price in the following months, falling below $3,700 by December 2018. This high price volatility is one of the biggest issues associated with cryptocurrencies, which can often experience price fluctuations of 5 to 10 per cent in a single day. And it was the desire to eliminate this volatility that led to the creation of stablecoins.

Stablecoins – a solution to the crypto market’s volatility?

Stablecoin is a new type of cryptocurrency the value of which is tied to a stable real-world asset. This asset could theoretically be almost anything, but it’s usually a fiat currency, such as the dollar or euro, another cryptocurrency, or a commodity like gold. That makes stablecoins similar to conventional currencies and practically eliminates the volatility that often plagues the crypto market. Stablecoins can be divided into two main categories: reserve-backed and algorithmic.

Reserve-backed stablecoins are called that because they’re backed one-for-one by the reserves of the currency they’re pegged to. What that means is that the issuers of reserve-backed stablecoins ‘tokenise’ dollars by exchanging them for stablecoins in a one-to-one ratio. The dollars are then deposited into a bank account, where they’ll remain until the stablecoins are exchanged back for the dollars. This security – the knowledge that stablecoins can always be redeemed – is what sets them apart from early cryptocurrencies like Bitcoin and allows them to retain their value.

Algorithmic stablecoins, on the other hand, are controlled by an algorithm, rather than being backed by some sort of reserve. This makes them more difficult to design, which is why they’re fewer in number and their performance remains largely unproven. “They’re really using software rules to try and match supply with demand to maintain a peg to something like the US dollar,” explains Garrick Hileman, the head of research at the crypto wallet provider Blockchain and author of a recent stablecoin report. “As demand for an algorithmic stablecoin increases, supply also has to increase to make sure there’s not an appreciation in the value of the stablecoin. At the same time, as the value decreases, there needs to be a mechanism by which supply can be reduced again to try and bring the price of the stablecoin back to the peg.” Some of the most popular algorithmic stablecoins in development are Basis, Carbon, Terra, and Fragments.

The best of both worlds

Stablecoins combine the best of both worlds: the stability and trust of mainstream currencies and the ability to transfer value digitally without going through the banking system provided by cryptocurrencies. “For millions of individuals, tens of millions in our view, as well as institutions, the volatility of crypto assets that we saw last year really is keeping a number of people’s [sic] on the sidelines of the cryptocurrency movement,” says Hileman. “Stablecoins can address that and enable a number of use cases that bitcoin or ether or other more volatile cryptocurrencies are suboptimal for – things like insurance.” For the time being, stablecoins are mostly used as a liquidity tool for cryptocurrency exchanges.

Since most banks are reluctant to deal with cryptocurrencies, many exchanges have been cut off from the mainstream banking system and are unable to accept dollar or euro deposits. This presents a major problem for the crypto market, because people want to be able to buy cryptocurrencies with dollars and exchange them back for dollars anytime they want. And that’s where stablecoins come in. That’s not all, though. Stablecoins could have many other applications as well, including insurance, loans, savings, and smart contract dividend payments.

The total market value of stablecoins is estimated at $3 billion

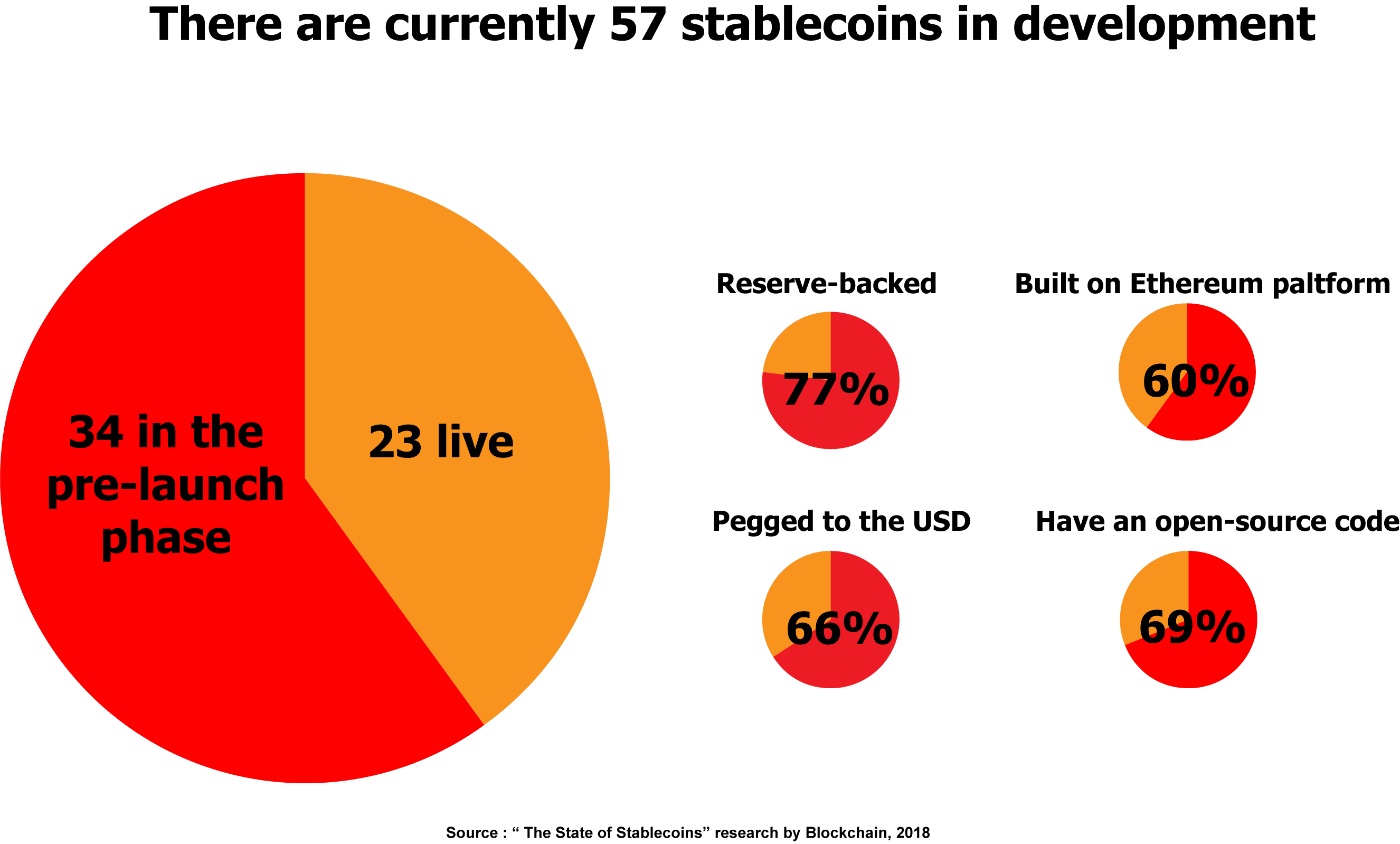

The number of active stablecoin projects has increased significantly in the past year. According to a recent report published by Blockchain, there are currently 57 stablecoins in development, 23 of which are already live, while the remaining 34 are in the pre-launch phase. Out of 57 stablecoins identified by the report, about 77 per cent are reserve-backed, with 66 per cent of those pegged to the US dollar. The majority of stablecoins, about 60 per cent of them, are built exclusively on the Ethereum platform. After Ethereum, the most popular technology platforms for stablecoins are Bitcoin, Stellar, and NEO. About 69 per cent of stablecoin project teams have open-sourced their code to make it available for audit inspection.

Despite being a relatively new development, stablecoins have already become an important component of the digital assets ecosystem and are listed on more than 50 different exchanges. Their total market value is estimated at $3 billion, which accounts for 1.5 per cent of the total market value of all crypto-assets. So far, stablecoin project teams have managed to attract more than $350 million in venture funding from the likes of Bain Capital Ventures, Google Ventures, and Andreessen Horowitz. No less than $174 million has been raised by algorithmic stablecoins, $144 million by traditional asset-backed stablecoins, and $33 million by crypto-backed stablecoins.

Tether is the most popular stablecoin

Tether (USDT) is currently the most popular stablecoin on the market. It accounts for approximately 98 per cent of the total daily stablecoin trading volume and 93 per cent of the entire stablecoin market value. It’s also the second most actively traded cryptocurrency, surpassed only by Bitcoin, and one of the top 10 cryptocurrencies by market value. However, Tether has also recently attracted a fair share of criticism for its auditing standards, corporate opacity, and alleged manipulation. Many investors are questioning whether Tether really has the dollars it claims to have in reserve, while others have suggested that it was only created to artificially inflate the price of Bitcoin. Despite the criticism, Tether has worked pretty well so far and has managed to maintain its peg to the US dollar as promised. Its price did briefly fall below $0.93 due to the controversy, but it quickly recovered and reverted to its original value. Still, this development did raise some concerns about whether stablecoins are really as stable as they claim to be. As a result, others have tried to improve upon Tether’s design and provide a better, more transparent solution.

Circle, a cryptocurrency group in Boston backed by Goldman Sachs, recently joined forces with the major cryptocurrency exchange Coinbase to launch a new dollar-pegged stablecoin called USD Coin (USDC). Unlike Tether, the USDC framework is open-source, and the accounts in which the collateralised dollars are held will be subject to regular public reporting of reserves, which should help raise the level of trust. Another difference is that USDC tokens are destroyed once they’re redeemed for dollars, while Tether tokens are just taken out of circulation and there’s nothing to prevent the company from putting them back into circulation sometime in the future. USD Coin has already gained a lot of support and Circle recently announced a new $110 million investment round led by the crypto-mining company Bitmain, bringing its valuation closer to $3 billion.

Challenges and criticism

Scalability remains one of the biggest issues currently facing stablecoins. To reach a deep enough level of liquidity necessary to support some of the more interesting applications of the technology, reserve-backed stablecoins will require millions, or maybe even billions of dollars of investment, which could restrict their growth. “When you’re talking about use cases in the trillions, having any upward limit or friction on how quickly something can grow is potentially a huge problem,” explains Hileman. There are also a number of regulatory hurdles to overcome. Because stablecoins are more similar to fiat currencies, they could have a bigger impact on monetary policy than cryptocurrencies like Bitcoin. They may encounter stronger opposition from central banks because of it.

Some people are also questioning whether stablecoins can deliver on their promise. Preston Byrne, a fellow of the Adam Smith Institute and the former COO of the blockchain company Monax, believes that stablecoins are “doomed to fail”, while Bitfinex’ed, a prominent crypto Twitter account, says that “the only application for them is for scam exchanges to use it”. Some people have warned that connecting cryptocurrencies to commercial banks also poses a risk. “Commercial banks aren’t the lender of last resort,” says Tim Swanson, who runs the fintech advisory firm Post Oak Labs. “They themselves are a credit risk — they could go defunct and be shut down. If stablecoins ever become as popular as venture capitalists think they will, then they could be recreating the same sorts of credit risks that we saw during the [financial] crisis.”

Nearly half of all Bitcoin transactions are estimated to be involved in illegal activity

Many people fear that cryptocurrencies could be used to fund illegal activities, such as terrorism, money laundering, drug trade, or human trafficking. And judging by a recent report published by a group of Australian researchers, they may be right. Sean Foley of the University of Sydney, Jonathan R. Karlsen of the University of Technology Sydney, and Tālis J. Putniņš of the Stockholm School of Economics in Riga conducted a study of historical Bitcoin transaction data using two data analysis techniques called detection controlled estimation and network clustering and came up with some very troubling results.

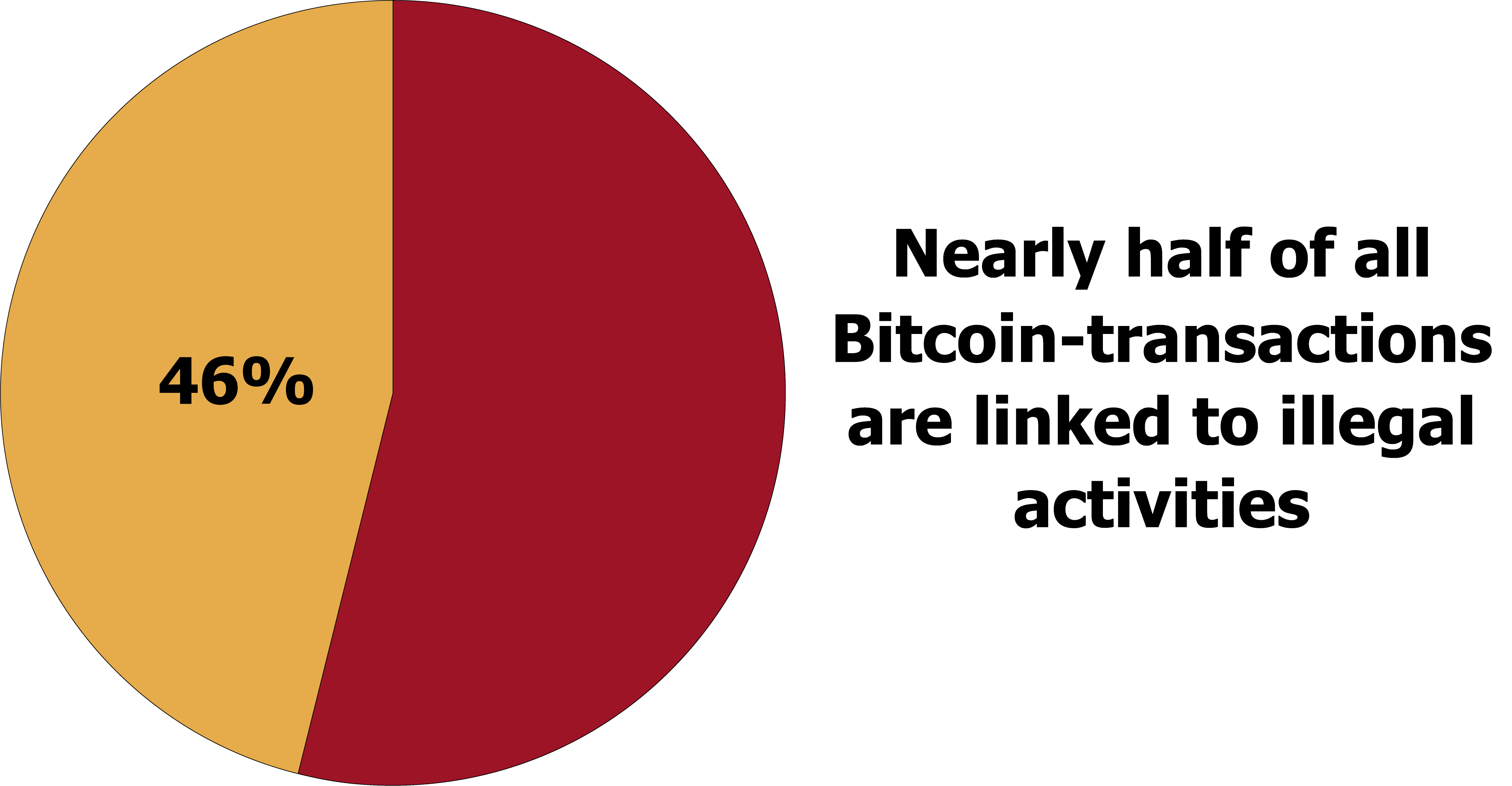

The researchers estimate that around one quarter of Bitcoin users and nearly half of all Bitcoin transactions, 46 per cent to be exact, are involved in illegal activity.

The total value of Bitcoin-related illegal activity amounts to $76 billion, which is nearly equivalent to the combined value of the US and European markets for illegal drugs. However, the researchers were quick to point out that these findings don’t necessarily mean that cryptocurrencies are facilitating the growth of the black market. Instead, criminals may simply be shifting their activities away from the streets and to the world wide web. Whatever the case, this is one problem stablecoins won’t be able to solve.

Regulatory hurdles

The lack of a universal regulatory framework is another major problem preventing the wider adoption of cryptocurrencies. The Law Library of Congress recently published a report that investigates the regulation of cryptocurrencies in 130 countries of the world. Most countries covered by the report have issued public notices warning their citizens about the dangers of investing in the cryptocurrency market. Some countries, like Australia and Canada, have gone one step further to expand their money laundering and terrorism financing laws to encompass cryptocurrency transactions and digital currency exchange institutions.

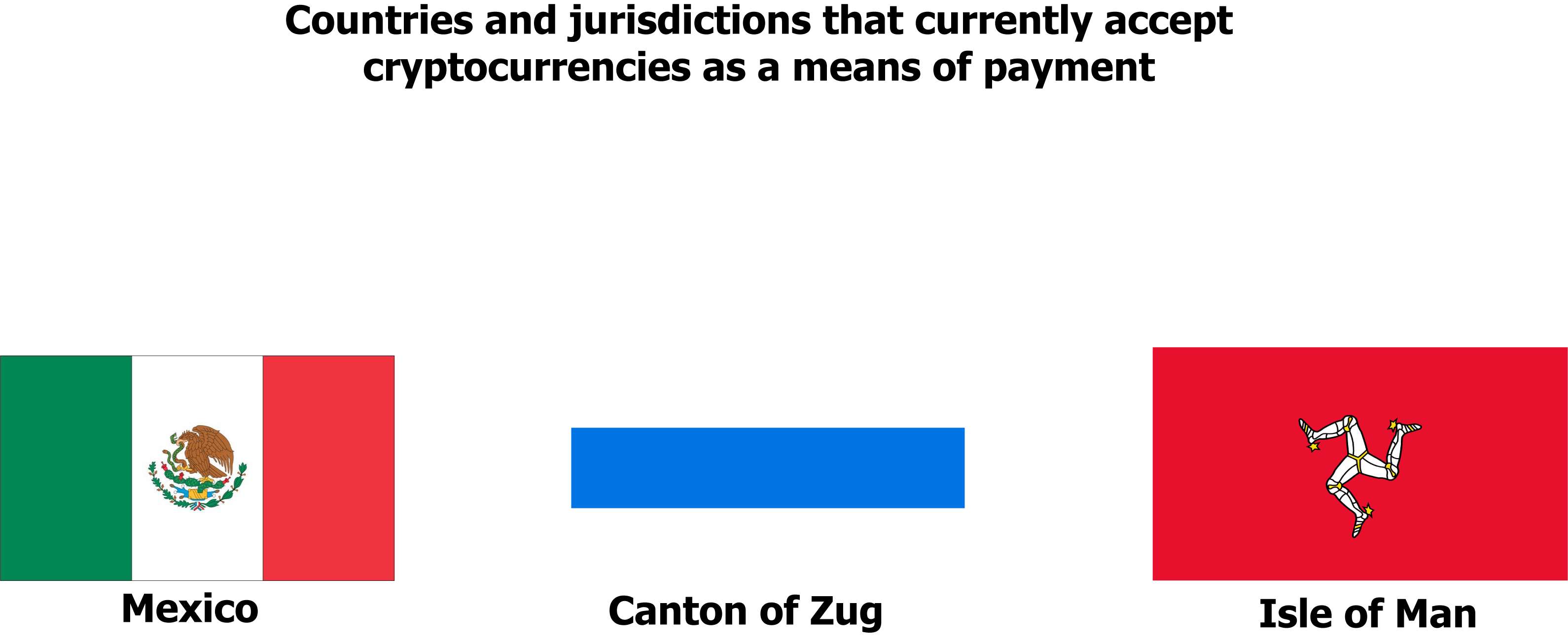

However, cryptocurrencies aren’t viewed as a threat by every country included in the report. In the United Kingdom, for example, the cryptocurrency market is considered too small to warrant regulation. Others have recognised the potential offered by this technology and are looking to develop a cryptocurrency-friendly regulatory regime or even issue their own cryptocurrencies. However, only a small number of countries and jurisdictions currently accept cryptocurrencies as a means of payment. These include Mexico, the Isle of Man, and the Swiss canton of Zug.

Stablecoins have managed to attract a great deal of attention in a short amount of time, but it’s still a relatively new technology so it’s difficult to say at this point what the future holds and whether stablecoins can really solve some of the issues that have plagued cryptocurrencies from the beginning. Furthermore, stablecoin design is constantly evolving, and we can expect to see a few more changes in that area before we settle on the optimal solution. Despite the growing criticism and a number of regulatory hurdles still left to overcome, stablecoins are a very promising idea that could have a wide variety of applications in the future and could very well be a stepping stone to the wider adoption of cryptocurrencies, facilitating their use as a medium of exchange.

Share via: