- Biometric security is superior to traditional passwords

- Chinese shoppers can pay with their faces

- India’s government used its official ID database to launch a payment app

- Vein patterns as a payment authorisation system

- Biometric payment cards are growing in popularity

- The challenges of using biometrics in payment systems

- Biometric authentication will be crucial for the finance sector in the future

The rise of a cashless society seems imminent. Paper money is giving way to credit cards, digital wallets, and mobile apps as millions of customers opt for electronic alternatives. The global mobile payments market, for instance, is set to reach nearly $3.7 trillion by 2024, while almost 80 per cent of retail sales in the UK in 2018 were made via credit and debit cards. While paying with cards and phones is convenient, it can also be risky. Criminals and hackers are constantly looking for ways to steal identities and money, with passwords and PIN codes being the weakest link in digital security.

Malicious individuals are adept at exploiting the weaknesses of our existing payment systems. Card fraud losses alone are predicted to grow to $31.67 billion worldwide by 2020, and millions of people are likely to have their bank accounts hacked. One way to tackle this problem is by changing the payment authentication methods we use. Instead of using passwords to approve a money transfer, banks and retailers are increasingly turning to biometric security, which uses an individual’s physical characteristics as an identifier. Copying someone’s fingerprints, face, or vein patterns has proven to be a much bigger obstacle for criminals than stealing PINs and passwords. And from tech giants and governments to universities and banks, various actors are using biometrics to protect their digital systems.

Biometric security is superior to traditional passwords

Millions of people still use ‘12345678’, ‘password’, ‘qwerty’, and other simple password choices to protect their online accounts. At the same time, “no two fingerprints have ever been found alike in many billions of human and automated computer comparisons”, says the Swiss Federal Police in The Fingerprint Sourcebook report.

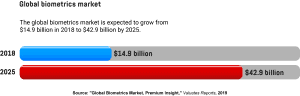

This and other examples illustrate the advantages of biometrics over passwords. That’s why it comes as no surprise that the global biometrics market is forecasted to reach $42.9 billion by 2025, up from $14.9 billion in 2018. Additionally, Goode Intelligence, a London-based consulting company, predicts that there will be more than 2.6 billion biometric payment users by 2023.

Chinese shoppers can pay with their faces

In China, cash and passwords are all but a relic of the past. The country boasts one of the most advanced mobile payment systems in the world, with smartphones playing a vital role in the financial services industry. But tech giants want to make payments even more convenient by using facial recognition technology.

Alipay, the financial unit of the e-commerce giant Alibaba, invested $420 million into developing its Smile-to-Pay system. The company deployed iPad-sized machines in hundreds of Chinese cities that enable customers to pay in stores just by posing in front of these camera-equipped devices. Prior to using this form of payment, people have to link an image of their face to a bank account or a digital payment system.

Tencent, the tech juggernaut that owns the WeChat app with 600 million users, has also unveiled a facial payment machine called Frog Pro. And many other Chinese startups are developing a range of biometrics-based services as well.

Stores in China are embracing facial payments, too. The IFuree self-service supermarket in the city of Tianjin, for instance, is equipped with 3D cameras that measure the width, height, and depth of the store visitors’ faces. When customers reach checkout, the system automatically charges their payment cards. Wedome, a bakery chain, has also deployed facial payment systems in over 300 hundred of its stores. Although the number of people using the new tech in bakeries is still modest, the company hopes that will change over time as more customers become enthusiastic about paying with their faces.

India’s government used its official ID database to launch a payment app

India is also turning into a significant market for biometric technologies. The country’s government used Aadhaar, an official identification database that contains citizens’ biometric information, to launch a digital payment system. Using the Aadhaar Pay app, customers can approve transactions in stores using fingerprint or iris scanners.

On the other hand, banks are now able to offer millions of unbanked citizens access to financial services using only their Aadhaar number and biometric identifiers. And building on the Aadhaar infrastructure, Axis Bank, the third-largest private bank in India, has deployed ATMs that run iris scans to approve transactions.

Vein patterns as a payment authorisation system

Besides faces and fingerprints, each person also has unique vein patterns inside their fingers. This biometric signature is invisible from the outside, but it can be mapped with the help of infrared lights and special cameras, and then used for secure authentication. A UK biometric startup called Fingopay has launched what it claims to be the world’s first payment solution that secures transactions by scanning blood vessel patterns. Customers have to link their vein signatures to payment cards, and the cloud-based matching system confirms payments in seconds. The system has already been trialled at several musical venues and higher education institutions.

At Brunei University, for instance, more than 1,000 students signed up to pay for groceries with Fingopay’s system. Copenhagen Business School has also deployed a vein biometric payment network across all five campuses, enabling students and staff to purchase food and drinks with their finger. Users were initially allowed to enrol in the system only with a Dankort, the Danish domestic card scheme. In 2019, however, Fingopay announced that it would also accept international payment cards, such as Visa and Mastercard.

Biometric payment cards are growing in popularity

Many customers love paying with their fingers or faces, as it’s fast, secure, and doesn’t require memorising complex passwords. Banks then decided to apply this tech to physical payment cards, giving rise to biometric cards. Instead of entering PIN codes, customers use fingerprints to approve card payments on a point-of-sale (POS) terminal. This improved authentication method will also enable banks to increase contactless transaction limits. And by 2023, there will be 579 million biometric payment cards in use, says Goode Intelligence, as dozens of banks are already trialling this new technology.

Royal Bank of Scotland and Natwest, both UK-based banks, are testing biometric payment cards as a way to scrap the £30 payment cap on contactless payments. Cornèr Banca, a Swiss private bank, launched the limited edition Cornèrcard Biometric Gold, a biometric card for high-value payments. And Fingerprint Cards AB, a Swedish manufacturer of biometric hardware and software components, says that 88 per cent of banks consider contactless solutions as “the main payment priority in the coming years”.

The challenges of using biometrics in payment systems

As some of the brightest minds on the planet race to protect customers against fraud, criminals are equally committed to breaking into sophisticated security systems. But hacking biometric-based payment solutions is undoubtedly harder than stealing PINs and passwords. Attackers would first have to get high-quality fingerprints of their victims. Then, they “would … have to lift that print, apply it to a substance, maybe gelatine, and then apply it to their finger to work in front of the shopkeeper”, says Stan Swearingen, the CEO of IDEX, a biometric technology provider for Mastercard.

The key value of biometric technologies is that they make hacking less scalable. Security teams have also found ways to make tricking facial recognition tech much harder. Liveness tests, for instance, can be deployed to ask users to read out randomly generated numbers to confirm that they’re alive, preventing criminals from using pictures of them to gain access to their accounts.

None of these measures, however, protect customers against being tricked into willingly sending money to criminals. That’s why it remains crucial to educate people on the dangers of social engineering, scams, and manipulations. There are other challenges as well. “Biometric data stored by a service provider is just as valuable a target as a database containing usernames and passwords,” says David Emm, a principal security researcher at Kaspersky Lab. Although stolen passwords can be changed, there isn’t much that customers can do about compromised fingerprints and other types of immutable biometric data.

Biometric authentication will be crucial for the finance sector in the future

The ever-growing popularity of cashless payments makes it evident that traditional passwords and PIN codes are no match for sophisticated hackers. The number of payment frauds and stolen credit cards is rising, forcing companies to use alternative authentication methods, such as biometric identifiers. Paying with faces, fingerprints, and vein patterns has proven to be more secure and convenient than using cash or passwords. And as tech companies continue developing biometric solutions, this technology will cement its place as a critical innovation in the financial services industry.

Share via: