- Regtech does in seconds what takes bankers hours

- Keeping all-knowing regulators informed

- Spotting risky behaviour before the problem escalates

- Software discovers things customers might want to keep hidden

- Being aware of every new regulation

- Tracking millions of transactions in real time

- Regtech isn’t a panacea for all regulatory challenges

- Respecting the letter and the spirit of the law

Most people aren’t familiar with obscure acronyms such as AML, KYC, MiFID II, and AIFMD, as they bear little or no importance in their lives. For bankers, however, ignorance isn’t an option. Those acronyms represent some of the many regulations that govern the finance industry and ensure the growth of a competitive and fair market. The adoption of new financial rules especially increased after the economic crisis of 2008 and the subsequent loss of trust in banks, as well as due to the growth of fintech and e-commerce. But that brought about new challenges, as complying with massive regulations became costly and difficult.

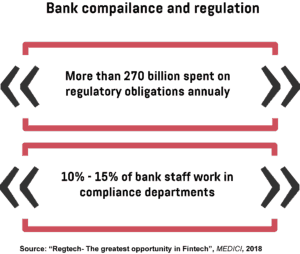

In fact, banks around the world spend more than $270 billion on regulatory obligations each year, with 10 to 15 per cent of their staff working in compliance departments. What’s more, the legal environment is bound to get even more complex as millions of pages of new regulatory documents will be published in the following years, and more than 750 global regulatory bodies will oversee their adoption. Clearly, the financial industry had to become more efficient to be able to comply with new laws, and that’s how the field of ‘regulatory technology’, or regtech, emerged. It promises to automate compliance procedures, standardise often unclear legal requirements, and save everyone time and money.

Regtech does in seconds what takes bankers hours

The appeal of regtech is that it delivers simple solutions to complex problems. Instead of employees spending hours tracking fraudulent transactions, verifying customer information, or preventing money laundering, regtech SaaS solutions do it in seconds. Take, for example, software that monitors transactions in real time. It works seamlessly in the background, and once it identifies a payment that’s connected with criminals or terrorists, it immediately notifies compliance officers to investigate the matter further.

Such early-warning systems can save banks millions of dollars in fines as regulators are usually unforgiving. Fines and penalties to banks for non-compliance amount to more than $100 billion each year. Danske Bank, for instance, has been charged for alleged violations of money laundering law in relation to its Estonian branch and is facing the possibility of a fine of around $4.5 billion. American authorities are also investigating Swedbank for possible money laundering. And since 2012, European banks such as the ING Group in the Netherlands, the Deutsche Bank in Germany, and BNP Paribas in France were fined over $16 billion for breaking money laundering or trade sanctions rules.

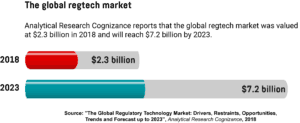

Therefore, clear market benefits and increasing regulatory pressure have contributed to the rise of the regtech market, which is forecasted to reach $7.2 billion by 2023. And the industry focuses on developing solutions in five key areas, including regulatory reporting, risk management, identity management and control, compliance, and transaction monitoring.

Keeping all-knowing regulators informed

Regulators monitor the overall health of the financial system to prevent market collapse and bankruptcy of individual organisations. To achieve that, they require banks, insurers, hedge funds, and other types of financial institutions to regularly submit relevant data. But delivering accurate reports is challenging, as bank employees have to use several sources of information, create multiple report formats, and possibly even deal with inadequate IT systems. To simplify that process, regtech startups developed a number of solutions that automate regulatory reporting.

The Israeli company Cappitech, for instance, developed regulatory reporting solutions that help banks, asset managers, and other financial institutions to comply with MiFID II, EMIR, ASIC, Best Execution, and other compliance rules. Its SaaS product enables clients to cut IT and HR costs and automate a significant portion of operations. And to fix any reporting issues and solve urgent problems, a dedicated team monitors client trades on an ongoing basis. Also, as new laws get frequently adopted, the company updates its product to help clients remain compliant.

REGIS-TR is European regtech company that’s assisting clients in complying with EU and Swiss reporting requirements. It’s developed a central repository system to which clients can report trades of various financial products such as derivatives, and regulators can then access the data and check whether companies follow the rules. REGIS-TR has also set up an office in London to be able to provide services in the United Kingdom in the post-Brexit era. And the company is preparing for new EU regulations such as the Securities Financing Transaction Regulation (SFTR) that are supposed to go live in 2020.

Spotting risky behaviour before the problem escalates

Another important factor to the success or failure of financial organisations is their risk management strategy. Properly executed, it will enable managers to promptly notice and address suspicious behaviour of individual employees, unusual transactions on accounts, or unfavourable market movements. To that end, regtech startups have developed several software products that spot risky events based on predefined criteria. And by relying on big data analysis and artificial intelligence, those tools can inform users about market changes and ways to mitigate risk.

For instance, a risk analysis tool developed by the British company Credit Benchmark produces alternative risk assessments to those of credit rating agencies. Also, the company gathers and processes financial data to provide risk indicators on companies that don’t have a rating from a credit rating agency at all. This creates a new source of information that has a number of use cases such as trend credit monitoring, portfolio tracking, macro analysis, model calibration, etc. The data is published monthly with “historical observations going back to May 2015”.

Provenir is a US risk analytics firm that provides an even broader range of regtech services. Its platform takes seconds to analyse mortgage applications, assign a risk score, and recommend the best course of action. The software pulls data from multiple sources and analyses it in a cloud computing environment. It can even use the risk score of existing clients, along with other data, to identify products they might be interested in, helping to improve customer retention. With a broad range of other anti-money laundering and loan analytics capabilities, Provenir remains one of the leading regtech providers.

Software discovers things customers might want to keep hidden

Whether a bank is investing in a profitable enterprise, forming a joint venture, or approving a loan, it must verify the identity of its clients and ensure that they pose no financial, legal, or reputational risk. A procedure called Know Your Customer (KYC) is required by regulators to prevent money laundering and identity theft. Also, banks want to determine that their potential partners have no history of bankruptcy, poor performance, political exposure, or fraud. And although KYC used to be manual work prone to human error, regtech offers a better solution.

Accuity, a global provider of regtech solutions, developed the Bankers Almanac for Risk and Compliance that helps financial institutions perform KYC procedures and quickly screen around 23,000 banks worldwide. The company also offers financial crime screening solutions under the Fircosoft brand that enable banks to identify accounts linked with sanctioned or politically exposed individuals or companies. The database behind these services is constantly updated with new people and organisations that have engaged in illegal activities or were placed under sanctions.

The Irish company Fenergo also boasts a powerful KYC platform that identifies high-risk companies and individuals. The software is compliant with multiple jurisdictions, such as those of the European Union and many Asian and American countries. The platform is capable of autonomously detecting all of the data and documentation that clients need to deliver for a bank to stay on the safe side of the KYC law. Fenergo claims that its solutions are used by 26 of the top 50 banks in the world including BNP Paribas, the Bank of China, UBS, Santander, and others. Also, the company promises 34 per cent savings in audit cost and a 30 per cent ROI on technology.

Being aware of every new regulation

Around 40 per cent of regtech startups offer solutions that keep financial institutions informed on new and updated regulations. Artificial intelligence (AI) and machine learning are typical technologies used in this instance. They automatically scan databases and websites, spot relevant information, and inform compliance officers. And with the increasingly complex legal environment and hefty penalties issued by regulators, regtech could save the finance industry billions by making sure that not a single new rule goes unnoticed.

The financial startup Capnovum, for instance, developed a repository that provides its clients with up-to-date regulations, obligations, and relevant news articles. The AI-powered platform enables financial institutions to manage compliance across more than 70 countries and 25 supranational jurisdictions. Capnovum claims that its software produces around 20,000 updates per week, and that smart algorithms assess connections between different regulations and their potential impact. The company has also been featured on the 2019 REGTECH100, an annual list of the world’s most innovative regtech businesses.

The tech firm Continuity is also making life easier for its clients by continually monitoring the Federal Register, the official journal of the federal government of the United States. Once relevant regulation is published or changed, the software prepares a summary and a list of actionable tasks that are then sent to financial organisations. This saves time for compliance officers as they no longer have to manually review each and every piece of information published by the Federal Register. Continuity claims that its solutions free “up to 90% of regulatory staff time for higher value work tasks”.

Tracking millions of transactions in real time

Regulatory obligations that prevent money laundering, fraudulent payments, and terrorist financing also mean that banks have to monitor financial transactions. But recognising and investigating illegal activities isn’t easy, and banks usually have entire departments dedicated to this task. Failure to deliver on this mission usually results in huge fines, as evident in the case of the Dutch bank ING. Regtech can help by using artificial intelligence and automation technologies to track transactions and alert banks about any illegal activities.

The Swedish tech company Trapets, for instance, developed the InstantWatch AML tool that monitors transactions for money laundering and terrorist financing. The software analyses transactions and customers using factors such as nationality, country of residence, account type, and product type. Also, it relies on multiple other data sources such as sanction lists, and follows rules laid out by EU regulations to assign a risk score to transactions. The system is highly scalable, analysing 500 million transactions per day and carrying out 10 billion pattern analyses.

But regtech startups aren’t only focused on the traditional financial sector. The tech firm Chainalysis developed software that analyses cryptocurrency transactions for illegal activities such as extortion, money laundering, and fraud. It’s used by financial institutions and law enforcement agencies alike as it can be applied across various digital currencies, including Bitcoin, Bitcoin Cash, Ether, and Litecoin. The software enables businesses to comply with strict KYT and anti-money laundering rules and avoid penalties and reputational damage.

Regtech isn’t a panacea for all regulatory challenges

In light of the many uses of regtech, it’s easy to think that software can help financial institutions tackle all regulatory requirements. But such thinking is far from reality, as Nizan Geslevich Packin, an assistant law professor at the Zicklin School of Business, City University of New York, writes for Forbes. For one, regtech isn’t easily accessible to a significant number of financial organisations due to the lack of money, data, and talented staff. And although it helps companies to automate compliance procedures, the technology is also used by regulators to automate their operations and further increase regulatory requirements, which negates the financial benefits that regtech provides in the first place.

Also, financial organisations risk by partnering with third-party vendors that might not be fully familiar with all the challenges and dangers present in the financial sector, argues Geslevich Packin. She questions whether software developers can turn all the nuances of legal rules explained to them by lawyers into code. And even if they manage to do that, banks and other institutions will place profit above anything else most of the time and use technology in a way that defeats its purpose.

For instance, banks already use various software tools to precisely calculate the bare minimum of liquidity and capital they need to pass the government’s stress tests and maximize profits. Getting as close as possible to avoiding regulation and treating laws as mere number games, however, isn’t what regtech is all about and won’t help us avoid financial crisis like the one in 2008.

Respecting the letter and the spirit of the law

The financial services industry is heavily regulated for a reason. A collapse of major banks can impact the global economy, destroy companies, and wipe out people’s savings. And as regulations get increasingly complex, regtech solutions ensure that financial institutions can comply on time and in a cost-effective way. But technology also makes executives overly confident. Some of them might approve far-reaching decisions just because algorithms say so, which in itself is risky behaviour, as noted by the central bank of the Netherlands. Others might abuse software and find ways to evade regulations and frustrate regulators.

Instead of seeing regtech as the cure-all solution for regulatory woes, financial actors need to shift their corporate thinking and obey both the letter and the spirit of the law. Transparent and sustainable business dealings are crucial for the world to avoid new economic disasters. Innovative technology can help us fix many problems in the system, and by changing our business culture, we’ll ensure that software can unleash its full potential.

Share via: